Inheritance Tax Changes 2026

The 2025 Autumn Budget introduced significant reforms to Agricultural Property Relief (APR) and Business Property Relief (BPR), which will have important implications for IHT planning for individuals, families, and business owners. Agricultural and Business Property Relief Reforms The 2024 Autumn Budget originally proposed a £1 million cap on the value of agricultural and business property […]

Know Your Worth: Why Understanding Your Business’s True Value Matters

In a dynamic economic environment, clarity is essential for SMEs. Without a solid understanding of your worth, how can SMEs begin to negotiate or seize opportunities? At Fiander ETL, we provide practical valuation services you can trust, grounded in market reality and backed by real-world evidence. Our independent, evidence-based approach helps business owners, investors, and […]

Applying FRS 102 Updates

For SMEs, adapting your organisation to a rapidly evolving professional landscape can feel like chasing a moving goalpost, and the 2026 FRS 102 updates are proving no different. From recalculating lease liabilities to reassessing revenue recognition, the upcoming changes are certainly set to keep finance teams on their toes. Associated Risks Include: Earnings Before Interest, […]

Preparing Your Business for the 2026/27 Financial Year

As this financial year enters its last few months, it is important to ensure your business is prepared. Staying on top of deadlines, reporting requirements, and business efficiencies will allow you to maximise profits going into 2026/27. At Fiander ETL, we can help you and your business to start the new financial year strong. We’ve […]

Key Tax Changes for UK Businesses in 2026

2026 is a pivotal tax year for UK businesses, with mandatory digitalisation of income tax and self-assessment for many sole traders and landlords, and inheritance tax changes that affect all business owners (it’s not just a ‘Farm Tax’!). As the tax landscape evolves, your individual circumstances will shape the best approach. Engaging an advisor early […]

Revised Approach to Corporate Reconstructions

The Finance Bill 2025-26 includes updates to anti-avoidance rules for share exchanges announced in the Autumn Budget 2025. Here at Fiander ETL, we wish to highlight the situations affected, what the changes are, why they occurred, and their practical implications. Situations Impacted Capital gains share reorganisation rules (section 127 and 139 in TCGA 1992) apply […]

New Year, New Strategies: Top Accounting Resolutions for 2026

Still managing your finances the same way you did last year? That approach could quietly cost you time, money, and clarity in 2026. Every January, optimistic business owners everywhere promise themselves that “this year will be different.” Yet by March, many are already back to their old habits of chasing missing receipts, experiencing cash flow […]

UK Expansion: Compliance & Growth for French Businesses

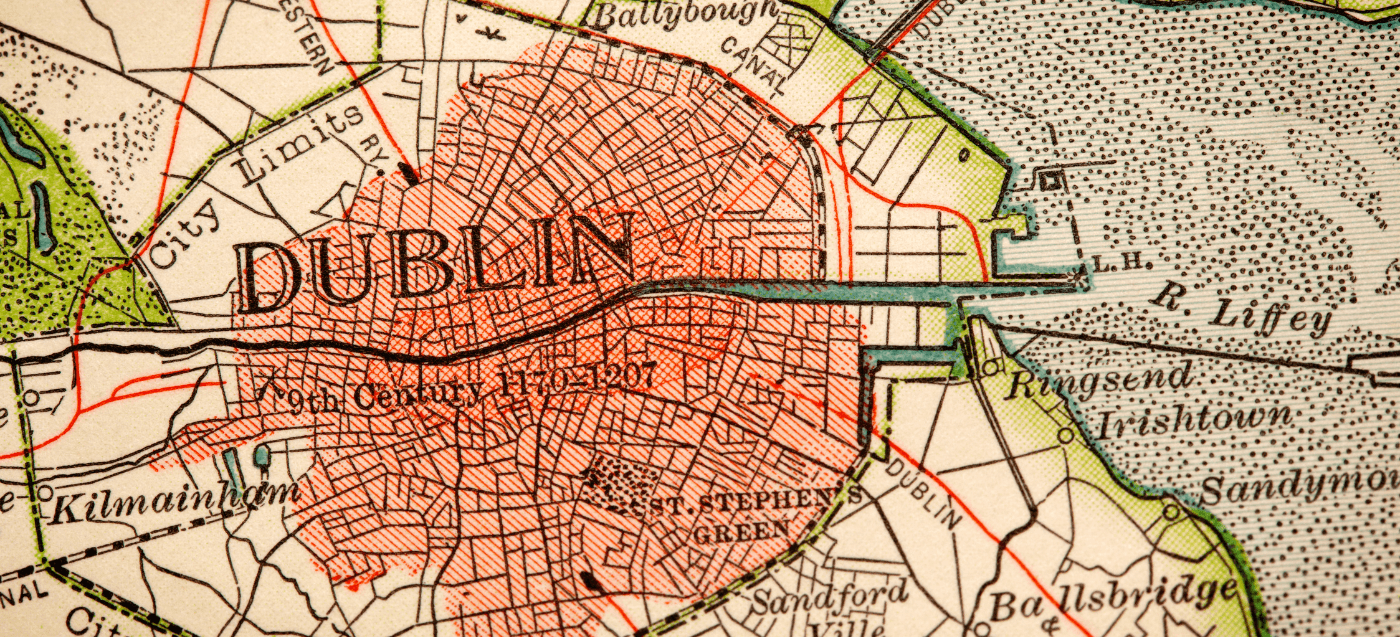

2026 is redefining EU market entry. As regulations tighten and cross-border rules evolve, Ireland is increasingly emerging as the preferred gateway for UK companies seeking stability and growth.

Naviguer entre conformité et croissance pour les entreprises françaises

2026 is redefining EU market entry. As regulations tighten and cross-border rules evolve, Ireland is increasingly emerging as the preferred gateway for UK companies seeking stability and growth.

Navigating AEOI Compliance for UK Trusts

2026 is redefining EU market entry. As regulations tighten and cross-border rules evolve, Ireland is increasingly emerging as the preferred gateway for UK companies seeking stability and growth.

Is Ireland Your Gateway to EU Growth in 2026?

2026 is redefining EU market entry. As regulations tighten and cross-border rules evolve, Ireland is increasingly emerging as the preferred gateway for UK companies seeking stability and growth.

Advisor Spotlight: Ciaran Simpkin

FRS 102 updates 2026 introduce major changes to UK GAAP, including a new five-step revenue recognition model and updated lease accounting rules. Learn how these changes impact financial reporting and what steps companies should take to prepare for the transition.